CrediChain

A decentralized blockchain-based lending and borrowing protocol

This platform allows users to:

CrediChain is a next-generation decentralized lending and borrowing protocol built on the CrossFi blockchain. It aims to disrupt the traditional lending market by removing intermediaries and providing users with an opportunity to directly participate in financial transactions. The protocol combines decentralized finance (DeFi) with smart contract technology, enabling users to borrow and lend digital assets with ease, while introducing an innovative credit scoring and risk management model.

The platform will also support the creation of a decentralized credit history that will allow users to access loans based on their on-chain behavior, providing an alternative to traditional credit scoring systems. Through CrediChain, users can engage in transparent, borderless, and permissionless lending and borrowing with complete control over their assets.✨

Problem Statement

Traditional lending systems and DeFi lending platforms face several significant challenges:

• Limited Access to Credit: Many individuals lack access to traditional banking and credit systems, leaving them excluded from financial services.

• High Interest Rates: Centralized lenders often charge high interest rates, creating barriers for borrowers who need affordable credit.

• Collateral Over-Collateralization: Many decentralized lending platforms require overcollateralization, which excludes potential borrowers who don’t have enough assets to cover a loan.

• Credit Risk and Fraud: Traditional credit scoring systems often fail to consider nonfinancial factors or introduce biases, while decentralized systems struggle to manage creditworthiness.

Solution

1. Decentralized Lending & Borrowing:

• P2P Lending: Users can directly lend and borrow digital assets without the need for intermediaries.

• Multi-Asset Support: CrediChain will support a variety of assets, including cryptocurrencies, stablecoins, and NFTs as collateral.

• Flexible Loan Terms: Borrowers and lenders can negotiate and customize loan terms based on preferences, such as loan duration, interest rates, and repayment schedules.

2. Decentralized Credit Scoring:

• Blockchain-Based Credit History: Instead of relying on traditional credit scores, CrediChain will use a decentralized credit history based on on-chain activity. Users can build their creditworthiness based on their borrowing and repayment history.

• Smart Contract-Driven Evaluation: Smart contracts will evaluate each user’s creditworthiness by tracking their transaction history, collateral, and borrowing behavior. This system eliminates the need for central authorities and ensures transparency.

3. Innovative Risk Management System:

• Dynamic Collateralization: Unlike traditional platforms that require over collateralization, CrediChain will introduce a dynamic collateralization model. Borrowers can use their assets more efficiently by providing adjustable collateral based on their creditworthiness and the loan term.

• Risk Pools: Lenders can participate in risk pools, which provide additional protection against borrower defaults, ensuring that lenders earn a steady income with lower risk exposure.

4. Interest Rate Algorithm:

• Algorithm-Driven Rates: The interest rates for loans will be dynamically set by an algorithm based on market conditions, borrower risk profiles, and available liquidity, ensuring fair and competitive rates for both lenders and borrowers.

5. Automated Liquidation System:

• Automated Liquidation: If a borrower’s collateral falls below the required collateralization level, the system will automatically liquidate the collateral to repay the loan, reducing the risk for lenders.

• Safety Nets: Borrowers will have the option to purchase insurance against liquidation, providing added security to borrowers while ensuring lenders’ interests are safeguarded.

Project Overview

Project Name: CrediChain

Requested Funding: 1k XFI Tokens

Purpose: To develop CrediChain, a decentralized blockchain-based lending and borrowing protocol that empowers users to borrow and lend assets seamlessly, securely, and with greater transparency, all while providing decentralized credit scoring and risk management systems.

Architecture

CrediChain is built on a robust architecture that utilizes several core technologies:

• Blockchain Integration (CrossFi Chain): The CrossFi blockchain will serve as the backbone of CrediChain, enabling secure, transparent, and immutable record-keeping of transactions.

• Smart Contracts: Smart contracts will facilitate the entire lending and borrowing process, including loan issuance, repayment tracking, liquidation, and interest rate management.

• Decentralized Credit Scoring: On-chain activity and behavior are tracked and evaluated via smart contracts to generate a decentralized credit score for each user.

• Risk Management Algorithms: An algorithmic risk management system will dynamically adjust collateralization requirements and interest rates based on market conditions and user profiles.

• Insurance and Liquidation Mechanism: Borrowers can purchase insurance against liquidation, and automatic liquidation ensures that lenders’ funds remain protected in case of default.

Key Features:

1. Decentralized Identity and Credit Scoring:

• Users will create blockchain-based profiles that track their financial behavior and loan history.

• The protocol will assess creditworthiness based on a user’s on-chain behavior, including repaying loans and interaction with the platform.

2. Collateralized Loans:

• Borrowers can take loans by collateralizing their digital assets, NFTs, or other blockchainbased assets.

• Dynamic collateral allows borrowers to adjust the collateralization ratio based on their needs and credit profile.

3. Interest Rate Flexibility:

• CrediChain offers an algorithmic interest rate model, which adjusts based on the borrower’s risk profile and market conditions, ensuring competitive rates for both lenders and borrowers.

4. Peer-to-Peer (P2P) Lending & Borrowing:

• Users can lend directly to other users, negotiate loan terms, and set flexible repayment schedules, ensuring more control and autonomy in the lending process.

5. Risk Pool Protection:

• Lenders can participate in risk pools, providing a safety net in case of defaults and offering higher returns with reduced risk.

6. Tokenized Liquidity Pools:

• Lenders can stake their funds in tokenized liquidity pools, allowing them to earn returns on their digital assets without directly engaging in lending.

Use Cases:

1. Borrowers:

• Access to Credit: Borrowers can access loans without intermediaries, offering them lower rates and greater flexibility compared to traditional banks.

• Efficient Use of Assets: Borrowers can use their digital assets more effectively by adjusting their collateral ratio according to their creditworthiness.

2. Lenders:

• Earn Interest: Lenders can participate in peer-to-peer lending and earn interest on their digital assets by lending them directly to borrowers.

• Risk Pools: Lenders can invest in risk pools, ensuring safer investments and more reliable returns.

3. Developers:

• Build on CrediChain: Developers can build new applications and financial products by leveraging the CrediChain protocol for decentralized lending and borrowing.

Vision for the Future:

CrediChain aims to be the go-to decentralized protocol for borrowing and lending, where individuals can take full control over their financial assets and have access to fair, transparent, and competitive lending conditions. By removing intermediaries and enabling users to directly negotiate terms, CrediChain is revolutionizing traditional finance and bringing decentralized finance to the masses.

Demo

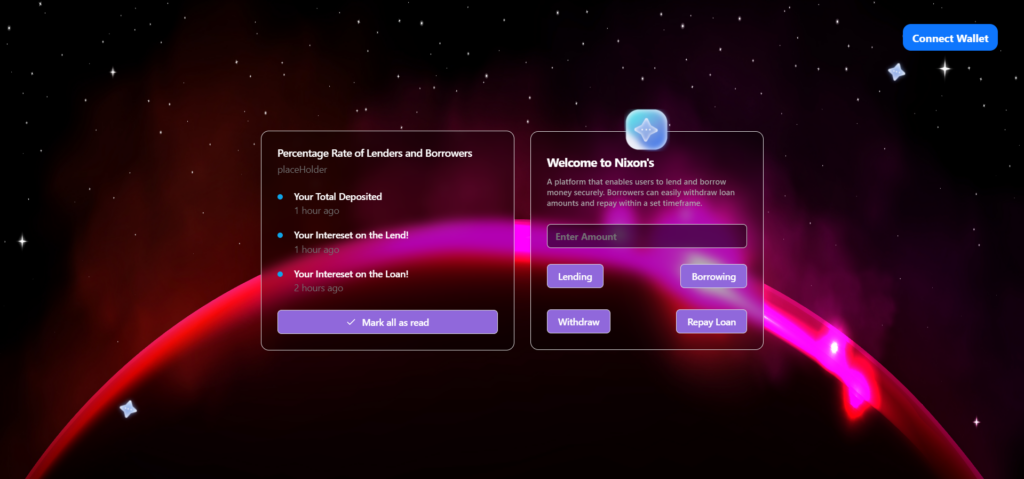

Home Page

With CrediChain, you can lend, borrow, and repay any amount securely using decentralized finance and on-chain credit scoring.

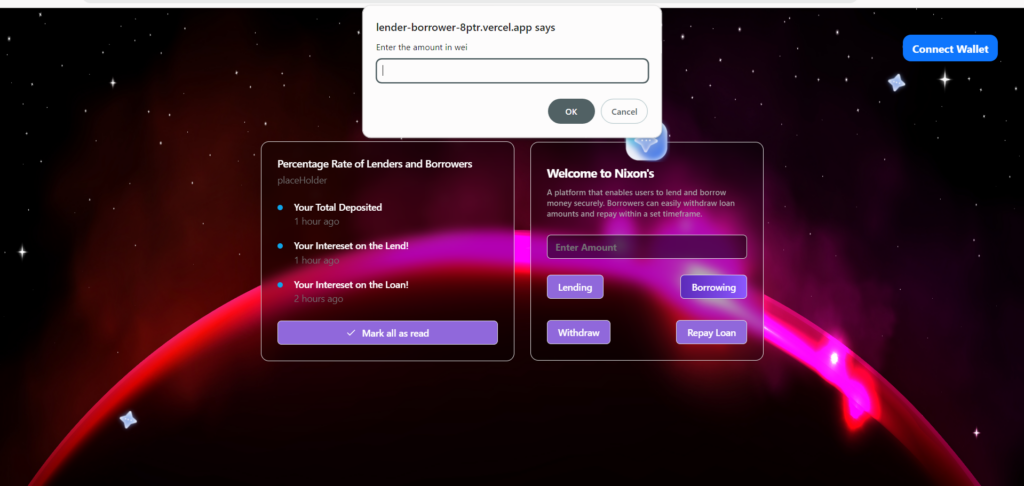

Borrowing

You can borrow money by entering the amount in Wei.

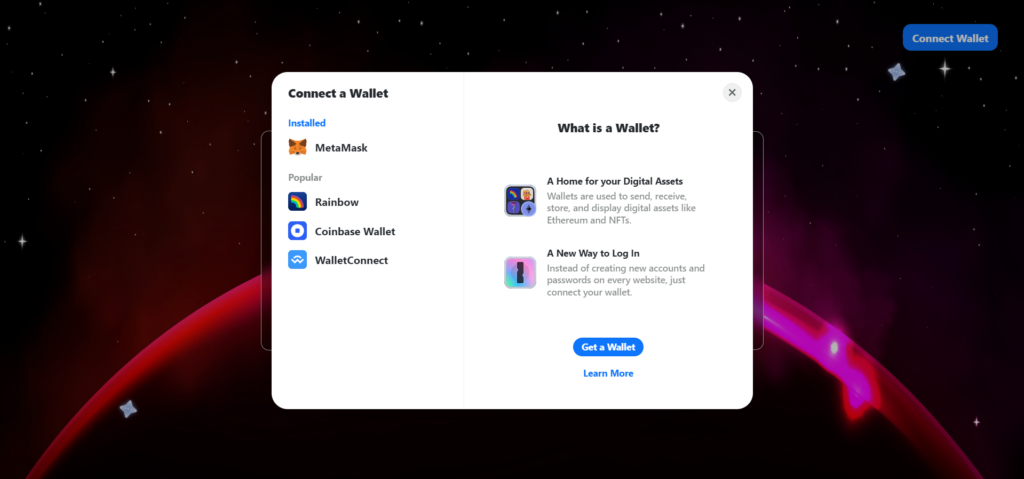

Create wallet

Here, you can connect to a wallet of your choice.

CONCLUSION:

With a funding request of 1k XFI tokens, CrediChain will create a decentralized, user-centric lending and borrowing platform that empowers both borrowers and lenders. By combining decentralized credit scoring, dynamic collateralization, and peer-to-peer lending, we aim to provide a more efficient, transparent, and inclusive financial system. Join us in building CrediChain, where lending and borrowing are decentralized, fair, and accessible to all.