FlexiStakeLoan

FlexiSTakeLoan is a decentralized finance (DeFi) smart contract enabling users to stake native tokens, borrow funds against their staked tokens, lend tokens for rewards, and manage loan repayments. The contract also handles defaults by forfeiting staked tokens and blacklisting borrowers.

- Staking: Users can stake native tokens to earn compounding rewards.

- Borrowing: Borrow against staked tokens with flexible loan durations (30, 90, or 180 days).

- Lending: Provide liquidity to the contract and earn compounding rewards.

- Loan Repayment: Repay borrowed amounts with interest and reclaim staked collateral.

- Default Handling: Automatic forfeiture of staked tokens for overdue loans, with borrower blacklisting.

- Rewards: Both stakers and lenders earn monthly compounding interest and annual bonuses.

- Admin Control: Owners can handle loan defaults and manage blacklisted users.

- Stake native tokens to earn rewards.

- Rewards accrue monthly (3% compounding) and annually (10% bonus).

- Borrow up to 50% of staked collateral.

- Loan durations available:

- 30 days (5% monthly interest).

- 90 days (7% monthly interest).

- 180 days (10% monthly interest).

- Lenders can deposit funds into the contract to earn rewards.

- Rewards accrue at 3% monthly compounding and 10% annually.

- Borrowers default if loans remain unpaid past their duration.

- Default consequences:

- Forfeiture of staked tokens.

- Blacklisting of the borrower.

- Handle loan defaults.

- Remove users from the blacklist.

- Interest Rates:

- Staking: 3% monthly, 10% annual bonus.

- Borrowing: 5%-10% monthly (depending on loan duration).

- Limits:

- Max Staked Amount:

1,000,000tokens. - Max Borrowed Amount:

500,000tokens.

- Max Staked Amount:

- Events: Tracks activities such as staking, borrowing, repayment, and rewards.

- Interest Rates:

- stakeTokens(): Stake native tokens to earn rewards.

- borrowTokens(uint256 _amount, LoanDuration duration): Borrow against staked tokens.

- repayBorrowedTokens(): Repay loan with interest and reclaim collateral.

- lendTokens(): Lend tokens to the contract.

- withdrawLentFunds(): Withdraw lent funds along with rewards.

- handleLoanDefault(address _borrower): Forfeit staked tokens and blacklist defaulting borrowers.

- removeFromBlacklist(address _user): Remove users from the blacklist.

Deploy the Contract:

- Deploy the

StakeToLoancontract on a supported blockchain.

- Deploy the

Stake Tokens:

- Call

stakeTokens()with the desired amount.

- Call

Borrow Tokens:

- Call

borrowTokens()with the loan amount and duration.

- Call

Repay Loans:

- Use

repayBorrowedTokens()to clear debt and reclaim collateral.

- Use

Lend Tokens:

- Use

lendTokens()to provide liquidity and earn rewards.

- Use

Withdraw Lending Rewards:

- Call

withdrawLentFunds()to claim rewards and principal.

- Call

Handle Defaults (Admin Only):

- Call

handleLoanDefault()for overdue loans.

- Call

- Staked(address indexed user, uint256 amount): Triggered when a user stakes tokens.

- Borrowed(address indexed user, uint256 amount, uint256 duration): Triggered when a user borrows tokens.

- RepaymentMade(address indexed user, uint256 amount): Triggered when a user repays a loan.

- Withdrawn(address indexed user, uint256 amount): Triggered when a lender withdraws funds.

- RewardsClaimed(address indexed user, uint256 amount): Triggered when staking rewards are claimed.Lent(address indexed user, uint256 amount): Triggered when a user lends tokens.

- LenderRewardsClaimed(address indexed user, uint256 amount): Triggered when lending rewards are claimed.

- LoanDefaulted(address indexed borrower, uint256 forfeitedAmount): Triggered when a borrower defaults on a loan.

- Ensure the contract is audited before deployment.

- Only stake what you can afford to lose.

- Monitor loan durations to avoid defaults.

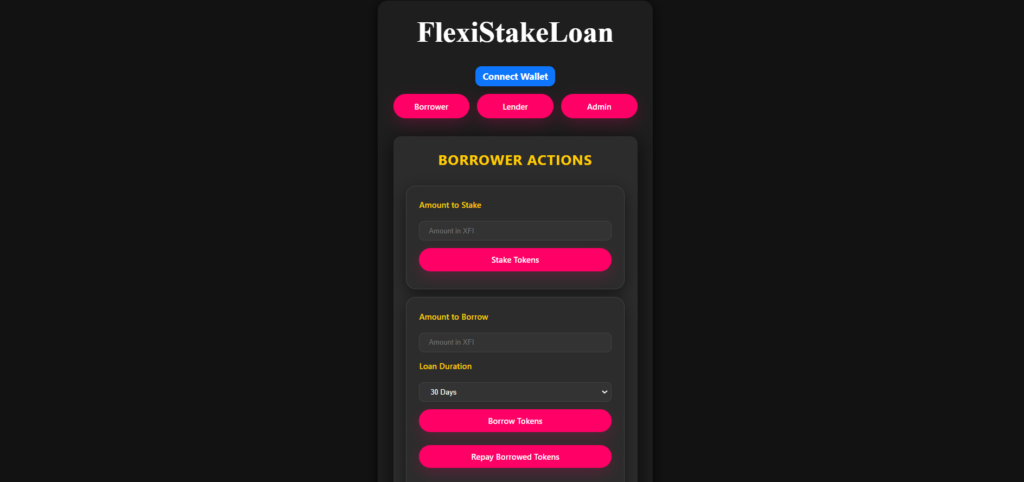

Demo

Borrower Section

Here, you can stake native tokens in XFIs and also can borrow and repay borrowed funds for a duration.

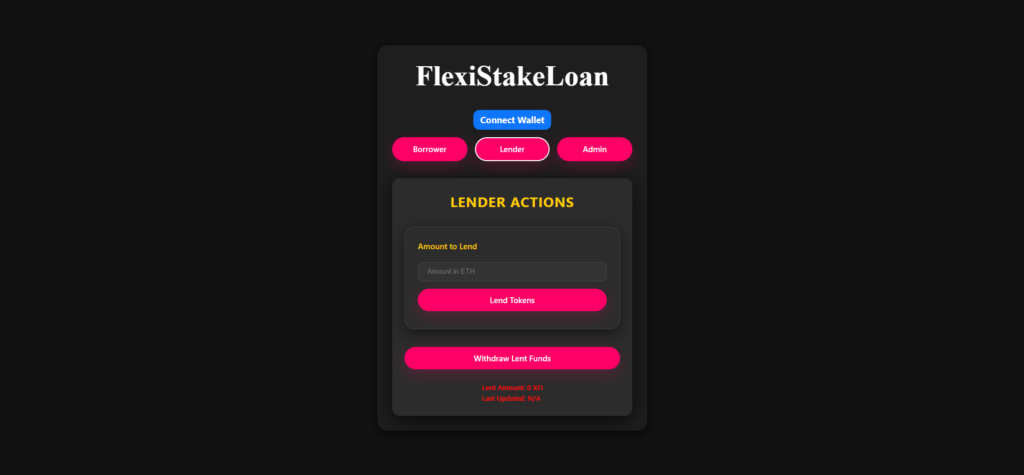

Lender section

Here, you can Lend tokens in XFIs and can also withdraw lend funds.

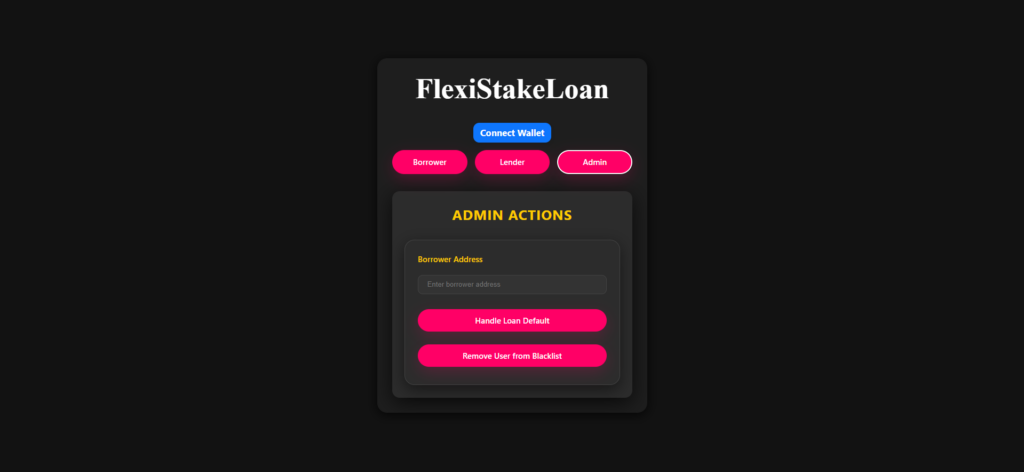

Admin section

Here, admin can handle loan defaults and can also remove user from blacklist.

conclusion

FlexiSTakeLoan is a decentralized finance platform that allows users to stake tokens, borrow funds against staked collateral, and lend tokens for rewards. It offers flexible loan terms, compounding rewards, and automatic default handling with borrower blacklisting. The contract ensures a secure and transparent ecosystem, benefiting both borrowers and lenders.