LendFi Protocol

A blockchain-based lending and borrowing platform

This platform allows users to:

LendFi Protocol is a blockchain-based lending and borrowing platform designed to enable users to lend their assets for interest or borrow against collateralized holdings without intermediaries. The protocol leverages smart contracts to ensure transparency, security, and automation in the lending

process.

This proposal seeks $1k XFI tokens to launch the LendFi Protocol on the CrossFi Mainnet, making decentralized finance (DeFi) accessible and efficient for the CrossFi ecosystem.✨

Problem Statement

Traditional lending and borrowing systems suffer from:

• Centralized Control: High reliance on intermediaries, leading to lack of transparency.

• High Fees: Borrowers and lenders often face high transaction and operational fees.

• Limited Accessibility: Many financial services remain inaccessible to a large portion of the population.

Even existing DeFi solutions face challenges such as limited cross-chain support and inefficient liquidation processes.

Solution

The LendFi Protocol addresses these issues by offering:

1. Decentralized Lending and Borrowing: Eliminates intermediaries, reducing costs and improving trust.

2. CrossFi Integration: Native support for the CrossFi Mainnet and other EVM-compatible chains for cross-chain asset management.

3. Automated Liquidation Mechanism: Reduces risks for lenders with smart contract-based liquidation of under-collateralized loans.

4. Flexible Collateral Options: Supports a wide range of assets, including stablecoins, native CrossFi tokens, and NFTs.

Project Overview

Project Name: LendFi Protocol

Requested Funding: $1k XFI tokens

Purpose: To establish a decentralized lending and borrowing protocol on the CrossFi Mainnet, offering transparent, trustless, and efficient financial services to users.

Architecture

1. Smart Contract Design:

• Lending Pools: Allow lenders to deposit assets and earn interest based on utilization rates.

• Borrowing Mechanism: Enables users to borrow assets by locking collateral in a trustless manner.

• Interest Rate Algorithm: Dynamic interest rates calculated based on supply and demand for each asset.

2. Security Features:

• Over-Collateralization: Ensures loans are secure, requiring borrowers to lock more collateral than the loan value.

• Audited Contracts: Implements rigorous testing and external audits to ensure the safety of funds.

• Oracle Integration: Uses decentralized oracles for real-time asset price updates, minimizing liquidation risks.

3. Unique Features:

• Collateralized NFT Borrowing: Allows users to leverage NFTs as collateral, unlockin liquidity without selling their assets.

• Community Governance: A governance module lets users vote on key protocol upgrades and interest rate adjustments.

Key Features:

• Seamless Lending & Borrowing: Intuitive interface for users to lend assets or borrow with minimal friction.

• Multi-Collateral Support: Accepts a variety of collateral types, including cryptocurrencies, stable coins, and NFTs.

• Dynamic Interest Rates: Adjusted algorithmically to balance supply and demand.

• Cross-Chain Compatibility: Enables cross-chain collateralization and asset transfers.

• Trustless Liquidation: Automatically liquidates under-collateralized loans to protect lenders.

Community and Ecosystem Benefits:

• Financial Inclusion: Provides access to financial services for users globally without the need for a credit score or banking relationship.

• Enhanced Liquidity: Promotes ecosystem growth by unlocking the value of idle assets through lending and borrowing.

• Economic Participation: Allows users to earn passive income by contributing assets to lending pools.

Demo

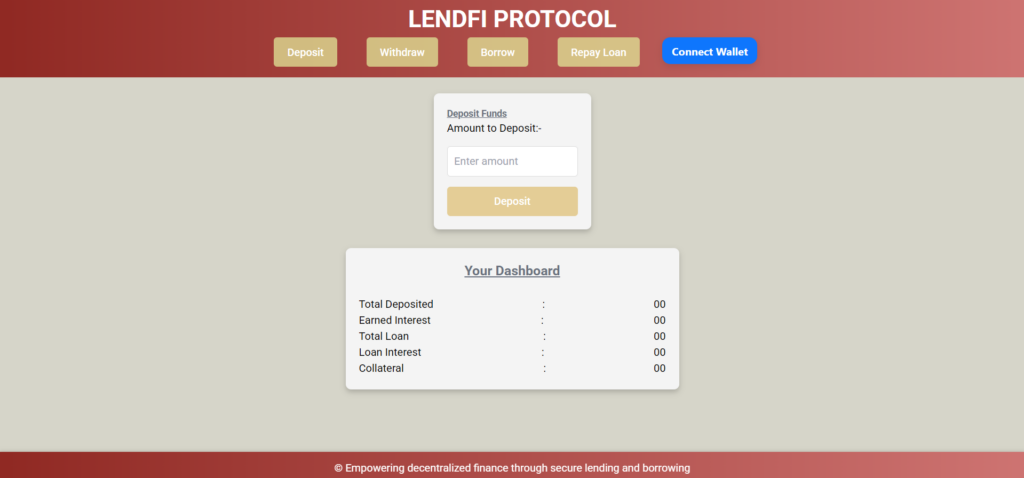

Home Page

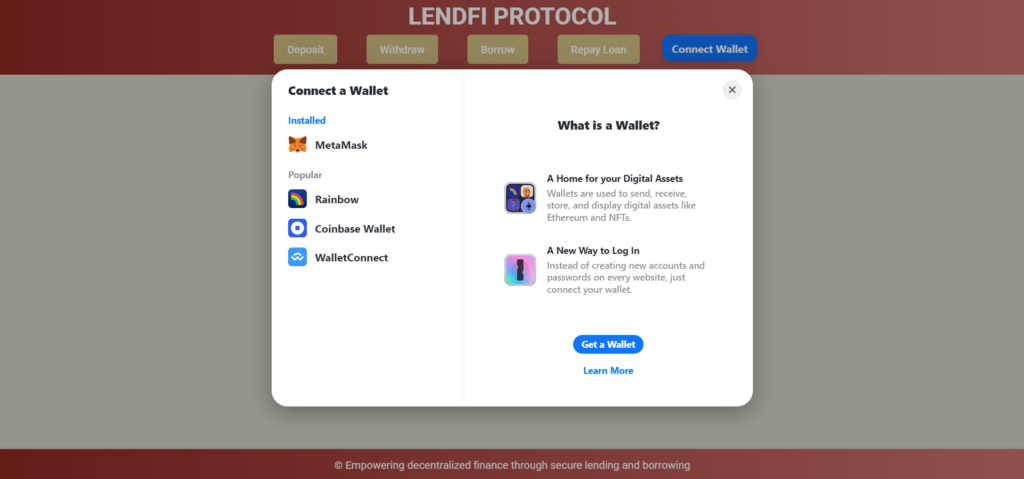

Connect to wallet

Future Scope

1. Yield Optimization:

- Integrate yield farming opportunities within lending pools for

enhanced returns.

3. Gas Optimization:

- Implement features to minimize gas fees for borrowers and lenders.

2. Under-Collateralized Loans:

- Explore credit-based lending mechanisms for trusted users or institutional borrowers.

4.Mobile Integration:

- Develop a mobile app for seamless user experience across devices.

5. Multi-Signature Governance:

- Introduce multi-signature wallets for community-approved

protocol upgrades

CONCLUSION:

LendFi Protocol aims to revolutionize decentralized lending and borrowing by offering a transparent, efficient, and secure platform on the CrossFi Mainnet. The requested $1k XFI tokens will facilitate its development, deployment, and initial ecosystem integration. By prioritizing user experience, security, and accessibility, LendFi Protocol is set to become a cornerstone of the CrossFi ecosystem, driving adoption and unlocking new financial opportunities for users worldwide.