Fixed yield Protocol

YieldX is a decentralized finance (DeFi) smart contract enabling users to tokenize and trade future yield. This innovative protocol separates asset ownership from its yield, allowing users to secure fixed-rate income or speculate on future yield. With a fixed 60-day maturity period, users can seamlessly trade tokenized yield while benefiting from a transparent and secure system.

Features

Depositing:

- Users deposit native tokens to receive principal and yield tokens.

- Deposits have a fixed maturity period of 60 days.

Tokenization:

- Native token deposits are tokenized into Principal Tokens (PT) and Yield Tokens (YT).

- Tokens can be traded or held until maturity.

Principal Withdrawal:

- After the 60-day maturity, users can withdraw their principal in native tokens.

Yield Claims:

- Yield Tokens can be redeemed for corresponding EDU yield after maturity.

Yield Token Trading:

- Users can sell their Yield Tokens to other users, enabling yield speculation.

- A 1% transaction fee applies to Yield Token sales.

Cancellation:

- Users can cancel deposits before maturity to reclaim their principal (conditions apply).

Fee Management:

- Admins can update transaction fees for Yield Token sales.

Contract Details

Deposit and Tokenization

- Deposit native tokens to receive:

- Principal Tokens (PT): Represent the deposit amount.

- Yield Tokens (YT): Represent future yield from the deposit.

- Maturity period: Fixed at 60 days.

- Interest rate: Fixed at 10%.

Principal Withdrawal

- Principal can be withdrawn after the maturity period.

- Users must burn their Principal Tokens (PT) to claim the native tokens.

Yield Claims

- Yield Tokens (YT) can be redeemed for EDU yield after maturity.

- Yield is calculated based on a 10% interest rate on the principal amount.

Yield Token Trading

- Sell Yield Tokens to another user.

- A 1% transaction fee applies to all trades.

- Enables flexible transfer of future yield.

Deposit Cancellation

- Users can cancel deposits before maturity.

- Depositors must not have sold any Yield Tokens (YT).

- Upon cancellation, both Principal Tokens and Yield Tokens are burned.

Contract Variables

- Interest Rate: Fixed at 10%.

- Fee Rate: Initially set at 1% for Yield Token transactions.

- Maturity Period: Fixed at 60 days (in seconds).

Functions Overview

User Functions

deposit(): Deposit native tokens to receive PT and YT.withdrawPrincipal(): Withdraw the principal after the 60-day maturity period.claimYield(address depositorAddress): Claim EDU yield using Yield Tokens (YT).sellYieldToken(address buyer, uint256 yieldAmount): Sell Yield Tokens to another user.cancelDeposit(): Cancel the deposit and reclaim the principal before maturity.

Admin Functions

updateFeeRate(uint256 newFeeRate): Update the transaction fee for Yield Token trades.

Utility Functions

getDepositDetails(address user): View deposit details for a user.calculateYield(uint256 amount, uint256 interestRate): Calculate yield based on principal and interest rate.

Usage Instructions

Deploy the Contract

- Deploy the PrincipalToken, YieldToken, and FixedYieldProtocol contracts on a supported blockchain.

- Initialize the FixedYieldProtocol contract with the addresses of PrincipalToken and YieldToken.

Deposit Native Tokens

- Call

deposit()with the desired amount of native tokens. - Receive Principal Tokens (PT) and Yield Tokens (YT).

Withdraw Principal

- Wait for the 60-day maturity period.

- Call

withdrawPrincipal()to reclaim your principal in native tokens.

Claim Yield

- Ensure maturity period has passed.

- Call

claimYield()using your Yield Tokens (YT) to receive EDU yield.

Trade Yield Tokens

- Call

sellYieldToken(buyer, yieldAmount)to sell Yield Tokens. - Buyer can claim the yield after the maturity period.

Cancel Deposit

- Ensure no Yield Tokens (YT) have been traded.

- Call

cancelDeposit()to reclaim your principal before maturity.

Events

Deposited(address indexed user, uint256 amount, uint256 maturityTime, uint256 interestRate)YieldTokenSold(address indexed seller, address indexed buyer, uint256 yieldAmount)PrincipalWithdrawn(address indexed user, uint256 amount)YieldClaimed(address indexed user, uint256 amount)DepositCanceled(address indexed user, uint256 principalRefunded)FeeUpdated(uint256 newFeeRate)

Security Considerations

- Ensure the contract is audited before deployment.

- Only deposit funds you can afford to lose.

- Monitor the maturity period to avoid missing deadlines.

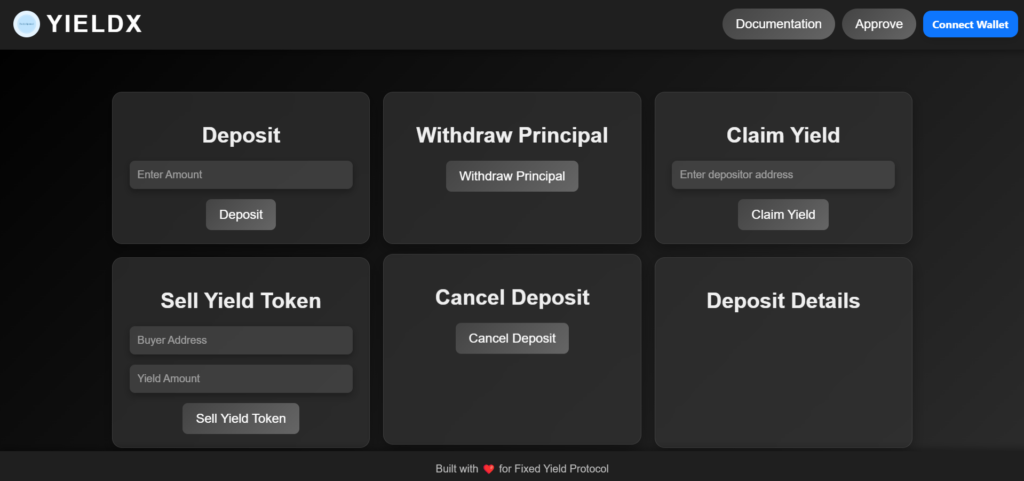

Demo

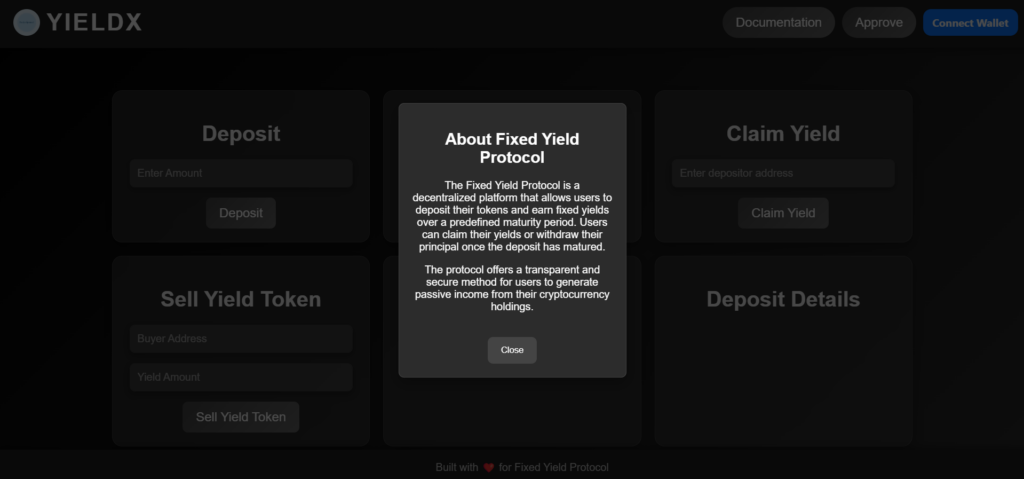

YieldX Dashboard

Here, You can deposit you yield tokens, withdraw principle, claim yield, sell yield and also you can cancel you deposit. Also you can see details of your deposit.

Documentation

Read about the project and its features

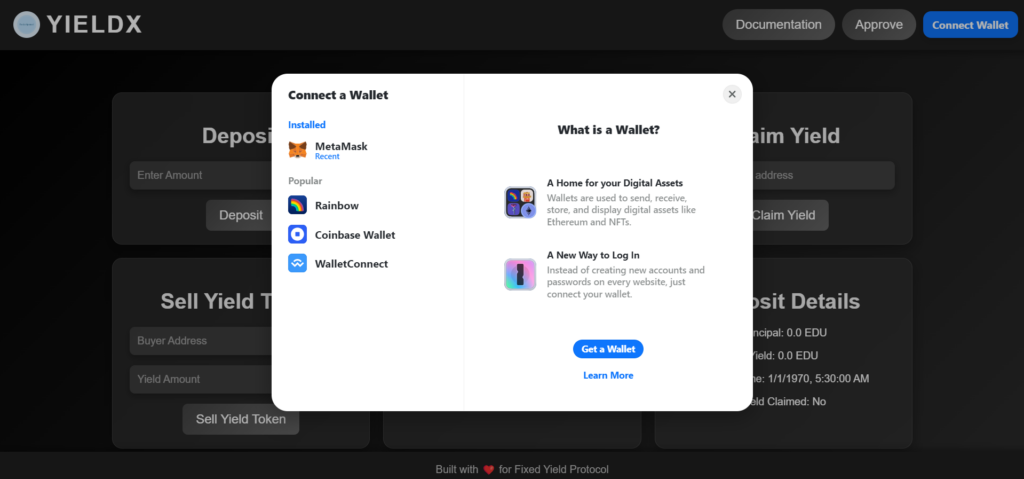

Connect to wallet

You can connect to wallet of your choice via rainbow wallet.

Vision for the Future

YieldX offers a robust and innovative decentralized finance protocol, enabling users to tokenize and trade future yield with ease and security. By separating asset ownership from its yield, it provides opportunities for both fixed-rate income and speculative yield trading. With a transparent system, a fixed maturity period, and various user functions, YieldX simplifies yield management while maintaining security and flexibility.